3 Major Reasons: This Isn't a Housing Bubble

Home prices continuing to deliver double-digit increases however some are concerned we’re in a housing bubble like the one in 2006. Let's take a closer look at the market data that indicates that this is nothing like 2006.

Here are the 3 Major Reasons

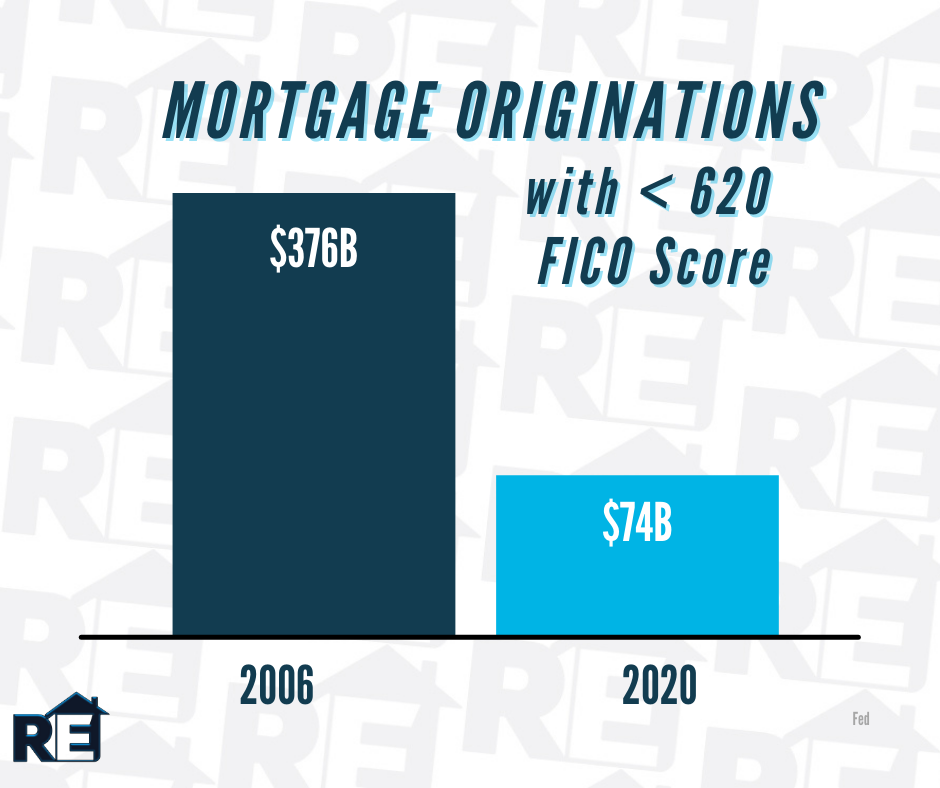

1. The housing market isn’t driven by risky mortgage loans.

Nearly everyone could qualify for a loan back in 2006. The Mortgage Credit Availability Index (MCAI) from the Mortgage Bankers’ Association is an indicator of the availability of mortgage money. The higher the index, the easier it is to obtain a mortgage. The MCAI more than doubled from 2004 (378) to 2006 (869). Today, the index stands at 130. As an example of the difference between today and 2006, let’s look at the volume of mortgages that originated when a buyer had less than a 620 credit score.

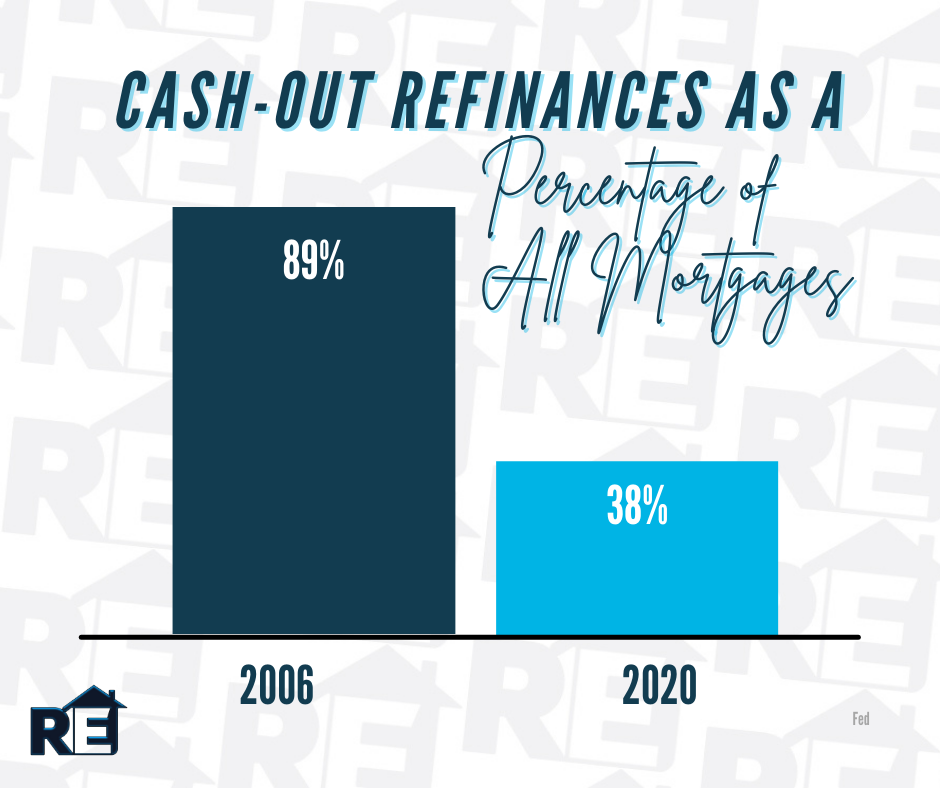

2. Homeowners aren’t using their homes as ATMs this time.

As prices skyrocketed, people were refinancing their homes and pulling out large sums of cash during the housing bubble. As prices began to fall, that caused many to spiral into a negative equity situation (where their mortgage was higher than the value of the house).

Today, homeowners are letting their equity build. Tappable equity is the amount available for homeowners to access before hitting a maximum 80% combined loan-to-value ratio (thus still leaving them with at least 20% equity). In 2006, that number was $4.6 billion. Today, that number stands at over $8 billion.

Yet, the percentage of cash-out refinances (where the homeowner takes out at least 5% more than their original mortgage amount) is half of what it was in 2006.

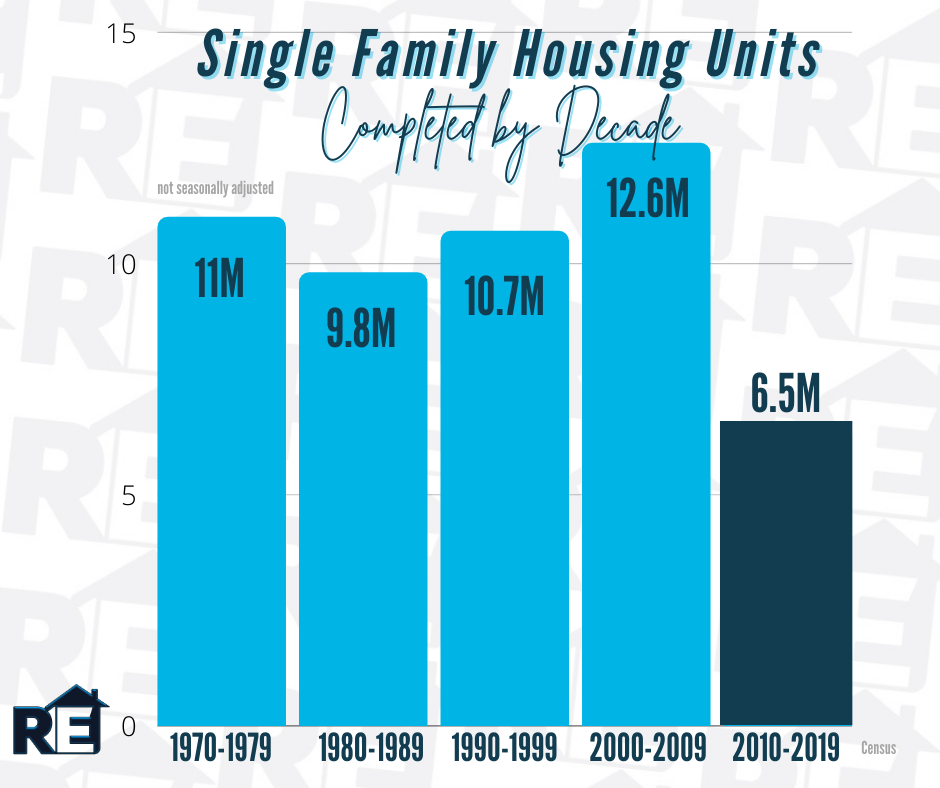

3. It’s simply a matter of supply and demand this time.

FOMO (the Fear Of Missing Out) dominated the housing market leading up to the 2006 housing bubble and drove up buyer demand. Back then, housing supply more than kept up as many homeowners put their houses on the market, as evidenced by the over seven months’ supply of existing housing inventory available for sale in 2006. Today, that number is barely two months. Builders also overbuilt during the bubble but pulled back significantly over the next decade.

Today, there are simply not enough homes to keep up with current demand.

Categories

Recent Posts