Saving for a Down Payment?

Buying a home can be a daunting task, especially when it comes to saving for a down payment. According to a survey by the National Association of Realtors (NAR) and Freddie Mac, a majority of Americans believe that saving for a down payment is the biggest obstacle to homeownership. In fact, 66% of renters reported that they believed saving for a down payment would be a difficult task.

However, there are steps you can take to make saving for a down payment easier. First, set a goal and create a budget that prioritizes saving. Determine how much you need for a down payment and set a timeline. Then, begin to cut expenses where you can and consider ways to increase your income.

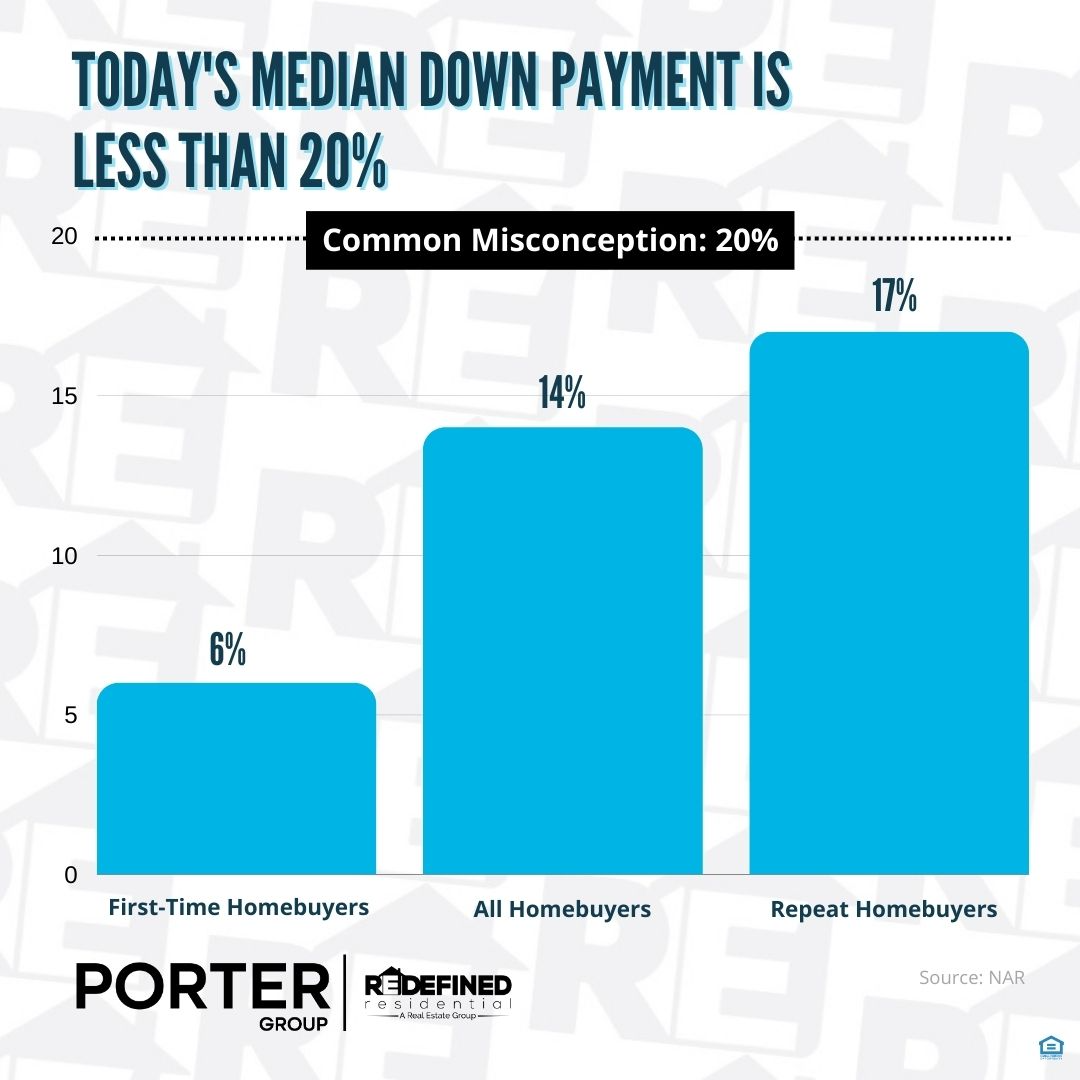

Here’s the good news. Unless specified by your loan type or lender, it’s typically not required to put 20% down. This means you could be closer to your homebuying dream than you realize.

According to NAR, the median down payment hasn’t been over 20% since 2005. In fact, the median down payment for all homebuyers today is only 14%. And it’s even lower for first-time homebuyers at just 6% (see graph below):

Learn About Options That Can Help You Toward Your Goal

It’s not just how much you need for your down payment that isn’t clear. There are also misconceptions about down payment assistance programs. For starters, many people believe there’s only assistance available for first-time homebuyers. While first-time buyers have many options to explore, repeat buyers have some, too.

Another way to make saving for a down payment easier is to explore mortgage options. There are a variety of mortgage programs available that offer low down payment options. For example, an FHA loan only requires a 3.5% down payment, while a VA loan offers 0% down for eligible veterans and service members. Additionally, some lenders offer programs that provide down payment assistance.

It's important to keep an eye on the housing market as well. A market update can provide valuable insight into whether it's a good time to buy or not. In general, it's a good idea to buy when the market is stable and interest rates are low. However, keep in mind that the housing market can be unpredictable, so it's important to work with a professional to make the best decisions for your specific situation.

Overall, saving for a down payment may seem challenging, but it's definitely achievable with the right plan in place. By setting a goal, creating a budget, exploring mortgage options, and staying informed about the housing market, you'll be well on your way to achieving your dream of homeownership.

Remember, a 20% down payment isn’t always required. If you want to purchase a home this year, let’s connect to start the conversation about your homebuying goals.

Schedule a Zoom Meeting with Steve!📅

Want to stay updated? Join our VIP Email List!

Categories

Recent Posts

2025 Housing Market Forecasts: What To Expect

Saving for a Down Payment?

Discover Sauganash Neighborhood

Proven Tips to Increase Your Home's Value

How To Prep Your Home For Sale

Luxury Living in the Heart of West Loop: A Closer Look at 1201 W Adams ST #704

The Ultimate Guide to Understanding Closing Costs in Real Estate

Why Pricing Your House Appropriately Matters

Avoid the Rental Trap in 2023

What To Expect From the Housing Market in 2023