The Difference Between Home Warranty & Home Insurance

It's crucial to conduct comprehensive study on every aspect of the home-buying process before making an offer on a new house. You'll need to be aware of the best ways to safeguard your investment and yourself in case something goes wrong. Check out the information on home insurance versus home warranty below to educate yourself on your options. Home Insurance Homeowners insurance pays for any accidental damages and loss that are caused by fire, lightning strikes, windstorms, and hail, however, damage from earthquakes and floods is typically not covered. It also covers the replacement of personal property in case of theft or damage and liability if a person were to get injured in your home or on your property. According to American Home Shield, the average annual cost of a homeowner's insurance policy ranges between $300 and $1,000, and the bank usually asks you to obtain a policy before the mortgage is issued. Make sure to keep in mind that each type of coverage in the policy is subject to a limit and, in most cases, you will have to pay a deductible. Home Warranty A home warranty is designed to cover the cost of repairs and replacements of larger appliances and crucial systems in your home that may fail or break due to age and wear and tear. This includes but isn’t limited to HVAC, electrical, or plumbing components, kitchen appliances, and your washer and dryer. With a home warranty, you are required to pay premiums year-round, even if you do not use it, and it won’t cover damages if appliances were not maintained properly or if the damage is from a fire or other disaster. Schedule a Zoom Meeting with Steve!📅 Want to stay updated? Join our VIP Email List!

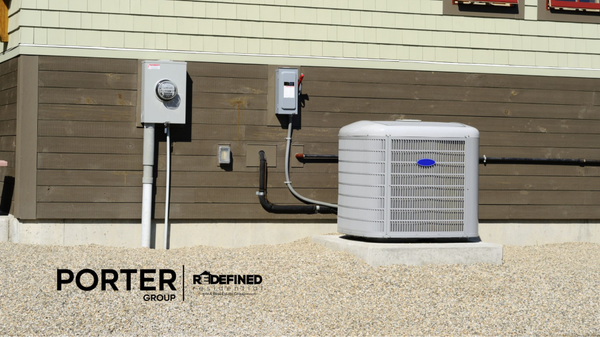

HVAC Maintenance Checklist

Every fall and spring, you should have your HVAC system inspected and maintained by a professional HVAC company. They will perform tasks that are a little more difficult for the typical homeowner, like inspecting and cleaning the wiring and mechanisms of the air conditioner and furnace. Here is a simple, attainable checklist for preventive maintenance to maintain your heating and cooling system in top shape. 10 Steps to Extend the Life of Your HVAC ✔️ If you haven't already, invest in a quality filter. The brand-new high-efficiency pleated filters include an electrostatic charge that functions as a magnet to pull in even the smallest particles, including bacteria-carrying ones. ✔️ At least once every 90 days, replace the filter. However, do so once a month. Change it if it appears to be black and congested. If you have pets, you should definitely replace it every month. ✔️ Make sure there is at least two feet of space between outdoor heat pumps and air conditioners. ✔️ In the spring, summer, and fall, clean the top and sides of outdoor air conditioners and heat pumps on a weekly basis to remove debris like leaves, pollen, and twigs. Don't let the grass clippings from the lawnmower fall onto the appliance. ✔️ Check the insulation on the refrigerant pipes entering the house once a month. Replace any damaged or missing lines. ✔️ Check that the unit is level. Ensure that outdoor air conditioners and heat pumps are placed on solid, level ground or pads once a year. ✔️ Prevent clogs. Pour a cup of bleach and water into the air conditioner condensate drain once a year to prevent the growth of mold and algae, which can clog the drain. ✔️ In the summer, turn off the water supply to the furnace humidifier. Replace the humidifier wick filter in the fall (or when you plan to turn on the heat), set the humidistat to between 35% and 40% relative humidity, and turn on the water supply. ✔️ Never close more than 20% of the registers in a house to prevent unnecessary strain on the HVAC system. ✔️ Replace the battery in your home's carbon monoxide detector annually. Schedule a Zoom Meeting with Steve!📅 Want to stay updated? Join our VIP Email List!

3 Graphs Showing Why Today’s Housing Market Isn’t Like 2008

With all the headlines and talk in the media about the shift in the housing market, you might be thinking this is a housing bubble. It’s only natural for those thoughts to creep in that make you think it could be a repeat of what took place in 2008. But the good news is, there’s concrete data to show why this is nothing like the last time. There’s Still a Shortage of Homes on the Market Today, Not a Surplus For historical context, there were too many homes for sale during the housing crisis (many of which were short sales and foreclosures), and that caused prices to fall dramatically. Supply has increased since the start of this year, but there’s still a shortage of inventory available overall, primarily due to almost 15 years of underbuilding homes. The graph below uses data from the National Association of Realtors (NAR) to show how the months’ supply of homes available now compares to the crash. Today, unsold inventory sits at just a 3.2-months’ supply at the current sales pace, which is significantly lower than the last time. There just isn’t enough inventory on the market for home prices to come crashing down like they did last time, even though some overheated markets may experience slight declines. Mortgage Standards Were Much More Relaxed Back Then During the lead-up to the housing crisis, it was much easier to get a home loan than it is today. Running up to 2006, banks were creating artificial demand by lowering lending standards and making it easy for just about anyone to qualify for a home loan or refinance their current home. Back then, lending institutions took on much greater risk in both the person and the mortgage products offered. That led to mass defaults, foreclosures, and falling prices. Today, things are different, and purchasers face much higher standards from mortgage companies. The graph below uses Mortgage Credit Availability Index (MCAI) data from the Mortgage Bankers Association (MBA) to help tell this story. In that index, the higher the number, the easier it is to get a mortgage. The lower the number, the harder it is. In the latest report, the index fell by 5.4%, indicating standards are tightening. This graph also shows just how different things are today compared to the spike in credit availability leading up to the crash. Tighter lending standards over the past 14 years have helped prevent a scenario that would lead to a wave of foreclosures like the last time. The Foreclosure Volume Is Nothing Like It Was During the Crash Another difference is the number of homeowners that were facing foreclosure after the housing bubble burst. Foreclosure activity has been lower since the crash, largely because buyers today are more qualified and less likely to default on their loans. The graph below uses data from ATTOM Data Solutions to help paint the picture of how different things are this time: Not to mention, homeowners today have options they just didn’t have in the housing crisis when so many people owed more on their mortgages than their homes were worth. Today, many homeowners are equity rich. That equity comes, in large part, from the way home prices have appreciated over time. According to CoreLogic: “The total average equity per borrower has now reached almost $300,000, the highest in the data series.” Rick Sharga, Executive VP of Market Intelligence at ATTOM Data, explains the impact this has: “Very few of the properties entering the foreclosure process have reverted to the lender at the end of the foreclosure. . . . We believe that this may be an indication that borrowers are leveraging their equity and selling their homes rather than risking the loss of their equity in a foreclosure auction.” This goes to show homeowners are in a completely different position this time. For those facing challenges today, many have the option to use their equity to sell their house and avoid the foreclosure process. If you’re concerned we’re making the same mistakes that led to the housing crash, the graphs above should help alleviate your fears. Concrete data and expert insights clearly show why this is nothing like the last time. Schedule a Zoom Meeting with Steve!📅 Want to stay updated? Join our VIP Email List!

Categories

Recent Posts